Many major players in the tire production industry are looking to pyrolysis-based chemical recycling to meet ambitious sustainability goals. Nevertheless, regulation such as RED II and the ‘Fit for 55’ package are driving heavy competition for material from the refinery sector.

Chemical recycling is an umbrella term for a number of technologies that alter the molecular structure of end-of-life materials, reverting them to an earlier state. In traditional mechanical recycling, the molecular structure remains unchanged throughout the process.

Pyrolysis is expected to be the dominant form of chemical recycling by capacity. It uses heat and pressure in an inert atmosphere. The typical output is pyrolysis oil, which – depending on specification – can be used as a fuel or naphtha substitute, or as a feedstock in carbon black production.

The exciting promise of pyrolysis-based chemical recycling is that it can take material not suitable for mechanical recycling and turn it back into virgin-like material. This doesn’t mean, though, that the quality of feedstock waste is immaterial to the output quality.

Input waste quality impacts:

- Pyrolysis oil yield;

- Level and type of impurities in finished pyrolysis oil;

- Final boiling point of the pyrolysis oil;

- Production equipment corrosion risk;

- Blend ratios for downstream cracker production;

- Aromatic and biogenic content.

Final boiling point and impurity levels are among the key determiners of pyrolysis oil prices. This is because they ultimately dictate the suitability of the output for use in a cracker, and at what blending ratio.

Typical impurities found in pyrolysis oil are similar to virgin naphtha, but often in higher concentrations. They include:

- Chlorine;

- Sulfur;

- Nitrogen;

- Oxygen;

- Fluorine;

- Silicone..

The advantage of tire-derived pyrolysis oil is that because the input composition is more predictable and less variable than plastic waste, the types and levels of impurities in the output pyrolysis oil are also more predictable. The disadvantage is that those impurities exist in higher concentrations.

Pyrolysis oil can be – and often is – run through an upgrader or purifier to enhance its properties, but this adds cost and time, as does any pre-treatment and sorting of the input waste. While there are players looking to incorporate tire-derived pyrolysis into crackers, cracker-suitable volumes remain limited and the vast majority of tire-based pyrolysis oil currently serves either the refinery or tire sector (where pyrolysis oil is used as a feedstock for carbon black which is then used to make new tires).

Cracker-suitable tire-based pyrolysis oil typically sells at several hundred euros/ton below cracker-suitable plastic-derived pyrolysis oil. This is partly because of the scarcity of plastic-derived pyrolysis oil, and partly due to the emphasis of consumer and regulatory pressure on plastic waste. This has meant, for example, that players in the packaging chain are broadly preferring plastic-derived volumes.

Plastic-derived naphtha substitute pyrolysis oil operating rates are substantially below nameplate capacity due to a combination of plant start-up delays, long commissioning times (in part due to difficulties in obtaining necessary environmental permits), and testing with various input mixtures meaning production is stop-start.

Pyrolysis oil fuel use is expected to grow in the mid-term. The adoption of ambitious targets with clear financial penalties has moved faster in the fuel sector than in plastic – which could divert both material from bio-based and pyrolysis oil sources away from the chemical chain and to fuel in the short-to-mid-term. This has been encouraged by parts of the ‘Fit for 55’ package’s seeming allowance of the use of pyrolysis oil to contribute to renewable fuel targets (such as those under RED II), provided emissions reduction criteria are met.

Tire-derived pyrolysis oil is typically cheaper than bio-based or plastic-derived pyrolysis oil alternatives.

The incorporation of natural rubber in most tires means there is also a biogenic component that can be commingled. As a result, this is encouraging the use of tire-derived pyrolysis oil in the first instance for fuel use – particularly for sustainable aviation fuel (SAF).

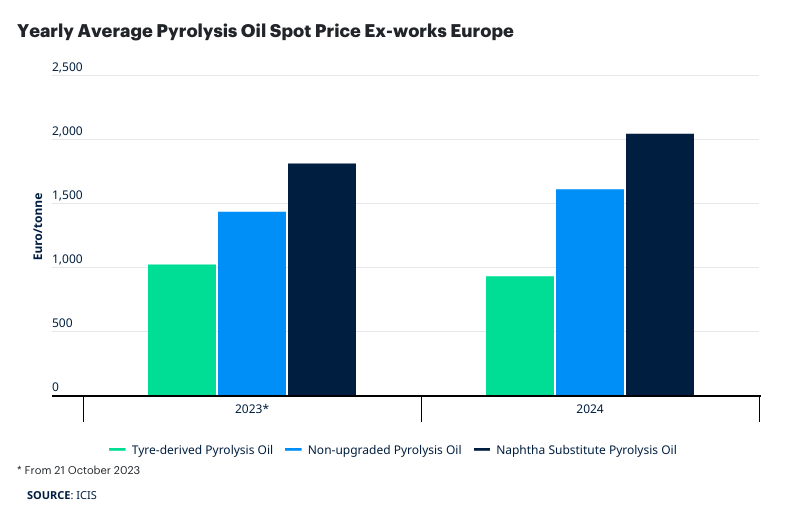

In 2024, plastic-derived non-upgraded ex-works Europe pyrolysis oil spot prices were, on average, €681/ton (US$743/ton) higher than standard tire-derived pyrolysis oil. Meanwhile, plastic-derived naphtha substitute pyrolysis oil (this is material suitable for use in a cracker instead of virgin naphtha at a replacement rate of 20%) was trading at an average of €1,114/ton (US$1,214/ton) above standard tire-derived pyrolysis oil in 2024.

The difference in prices is predominantly attributable to two factors – higher availability of tire-derived pyrolysis oil and impurity levels.

Existing regulation has meant that currently refinery-based buyers typically represent the top end of the tire-based pyrolysis oil price range and automotive buyers the low-end, leading to a preference for producers to target the refinery sector.

Nevertheless, the EU’s proposed ELV (end-of-life vehicles) Regulation could change this, and has been proposed as a replacement for the current ELV Directive.

The redraft of the ELV regulation remains at an early stage of its legislative journey. Nevertheless, it proposes ambitious minimum recycled content targets in new vehicles, with part of that target needing to be met through the incorporation of material from end-of-life vehicles.

The European Parliament Committee on the Environment, Climate and Food Safety and the Committee on Internal Market and Consumer Protection have proposed a series of amendments to the European Commission’s draft revision. This would appear to include the allowance of tire-derived pyrolysis oil to count toward mandated recycled content targets.

The proposed timeframe for the recycled content mandates is just six years after the ELV regulation enters into force. This is a very short timeframe for implementation in terms of car design, and could see demand from the automotive sector ramp up.

Meanwhile, there are significant headwinds to growth of the global pyrolysis oil market. These include:

- Lack of sufficient waste infrastructure;

- Long commissioning and permitting timeframes on new plants;

- A challenging financing environment reducing investment.

This is likely to mean the market remains structurally short in the mid-term, while intensifying legislation could push demand substantially higher.

Whether these headwinds can be overcome in time to meet rising need for material remains an open question mark.