Specialty chemicals group Lanxess is to sell its remaining 50% stake in Arlanxeo to joint venture partner Saudi Aramco. The two companies, which founded Arlanxeo in 2016 as a 50:50 joint venture for synthetic rubber, have signed a respective agreement.

The transaction is still subject to approval of the relevant antitrust authorities. At the same time, information or consultation of the competent employee representative bodies will take place. The parties expect to complete the transaction by the end of 2018.

Arlanxeo is valued at €3.0bn (US$3.5bn). Lanxess expects to receive approximately €1.4bn (US$1.6bn) in cash after deducting debt and other financial liabilities for its 50% share. Lanxess will use the proceeds to strengthen its financial basis and reduce net financial debt.

Originally Lanxess and Saudi Aramco agreed on a lock-up period until 2021 for both partners. “Through this transaction we will mark another important milestone in our strategic transformation earlier than originally planned. This will enable us to focus more on our position as a leading player in the mid-sized specialty chemicals markets,” said Matthias Zachert, chairman of the board of management.

“At the same time, the resilience of the business will be increased, the financial basis strengthened and we will become more flexible for further growth.”

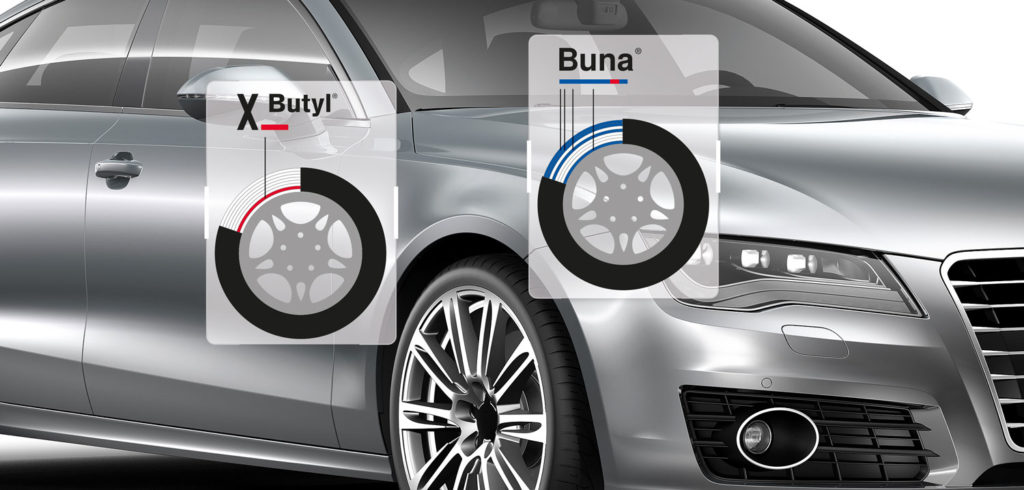

Headquartered in Maastricht in the Netherlands, Arlanxeo generated sales of around 3.2bn (US$3.7bn) in 2017 and employs about 3,800 people at 20 production sites in nine countries. The company produces high-performance rubber for use in, for example, the automotive and tire industries, the construction industry, and the oil and gas industries.

Back in 2016, the transfer of the business with synthetic rubber into the joint venture Arlanxeo was the foundation for Lanxess’s strategic realignment. Since then Lanxess has been focusing on growth in mid-sized specialty chemicals markets and made various acquisitions in this area – with the takeover of the US chemical company Chemtura in 2017 as the biggest one.