A new research report conducted by Smithers Rapra, The Future of Global Truck Tires to 2027, tracks how value in this sector will reach US$107.6bn in 2017.

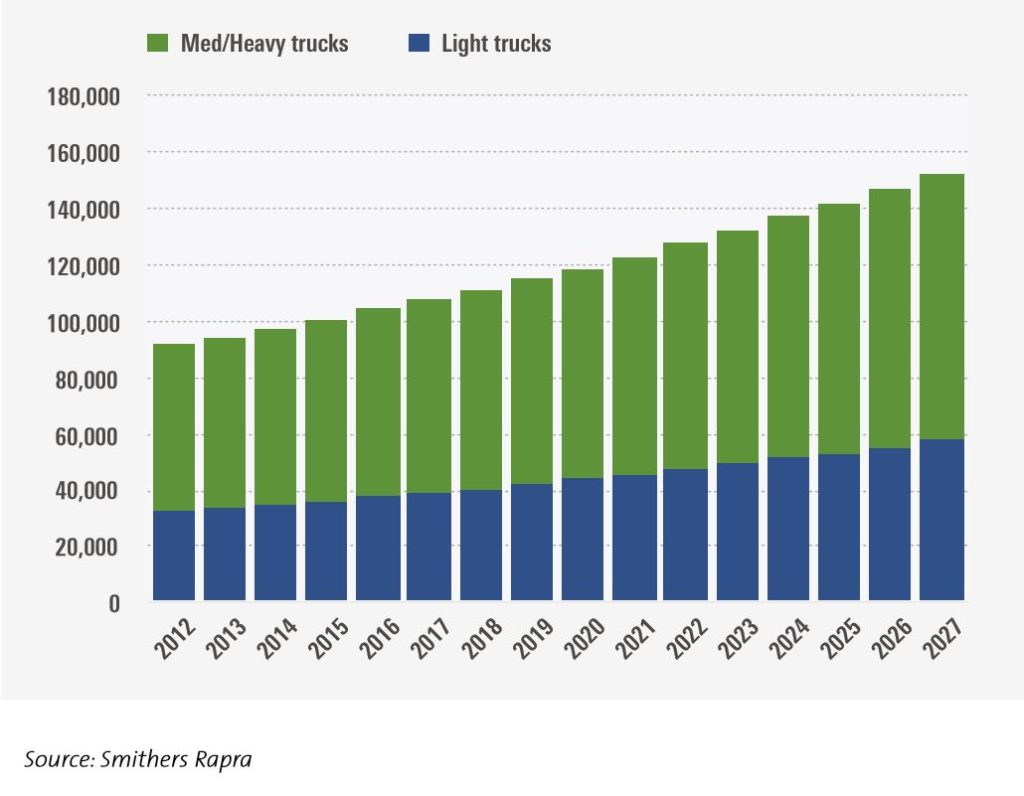

With year-on-year growth forecast at 3.5% across the next decade, this will reach US$152.4bn in 2027. After adjusting for price and raw material fluctuations, gains in tire manufacturing productivity, and then consumer potential of greater value adding features, volume consumption of all truck tires is predicted to increase at a rate of 3.2% per year from 2017–2027.

Smithers’ analysis sub-divides the truck tire market across all core segments – tire size, vehicle type, geographic and key national market.

For vehicles type, the light truck market has a 2017 value of US$40.0bn worldwide. It is expected to outperform the heavier truck segment across 2017-2027, with growth of 4.0% year-on-year. Medium and heavy truck tires – worth $68.6 billion in 2017 – are predicted to retain a healthy 3.3%annual expansion across the same period despite of a very sizeable retread market that is both symbiotic and competitive.

The truck tire market is nearly as diverse as the overall tire market itself and is influenced by many variables, including economic activity and specific trends in truck production, sales and size.

Evolving truck ownership models, fuel costs, driving patterns and behaviors, and the availability of alternative transport, are significant drivers of truck use, which in turn impact the performance requirements of future truck tires regarding miles driven, tire wear, and ultimately the replacement of both vehicles and tires.

Arthur Mayer, author of the report, said, “In the case of medium and heavy truck tires, the impetus for the adoption of new technologies is driven by economics more than regulations.

“And while it is a conservative and slow to change market segment, innovations that can provide fuel savings and maximize tire asset life are significant motivators in purchasing decisions.

“The main areas of technical innovation center on incremental improvement in critical performance criteria – such as rolling resistance, lifecycle and sustainability. Some supporting technologies related to tire inflation are especially important in truck tires. And merging disruptive innovations, such as autonomous driving, will have an increasing influence on technology development and implementation.”

Greenhouse gas emissions targets, fuel economy standards and initiatives, such as SmartWay in the USA, and tire labeling in the EU, are pushing the adoption of low rolling resistance truck tires, as well as tire optimization technologies – principally TPMS and automatic tire inflation systems.

Green tire standards, and the rapid development of autonomous vehicles, are generating the impetus for more smart features – such as RFID tagging and multifunctional sensors – embedded in tires.