We look back at David Shaw’sfascinating article from June 2020, examining how developments in software, AI predictive modeling and standardization of sensors will enable end users to reap the benefits of TPMS in the future

The first time I remember encountering a runflat tire was at a ride-and-drive day with Goodyear, when it launched an extended mobility tire (EMT) some time in the early 1990s. I remember asking how drivers would know the tire had lost pressure. At the time, none of the tire makers had fully realized that any vehicle using a runflat tire would need a factory-fitted TPMS to alert the driver to loss of pressure. Otherwise the driver might continue at speed for well over the 80km (50-mile) limit of runflat distance before the tire gave up completely.

A quarter-century after that ride-and-drive, runflats remain a niche product, having captured less than 10% of the consumer market and pretty much 0% of the commercial trucking market. On the other hand, TPMS has taken off in terms of its popularity, usage and mandated requirement. TPMS is now mandatory on all new passenger vehicles sold in the USA, Europe and China.

The latest incarnations of the technology have moved beyond the tire segment and can help save lives and improve business operations. It is the truck tire market, however, where TPMS and associated data analysis has become a tool to drive real profits in the tire industry. Although it was almost ignored on that ride-and-drive day, TPMS was the real success story around the attempts to convert the public to runflat tires.

Evolution of the TPMS

Since the early 1990s we have seen car makers try to reduce cost and complexity of TPMS technology by using antilock brake sensors as an indirect means to assess tire running diameter (and hence inflation pressure). We have also seen a range of valve-mounted aftermarket pressure sensors that can detect pressure (p), but don’t necessarily compensate for changes in temperature (T).

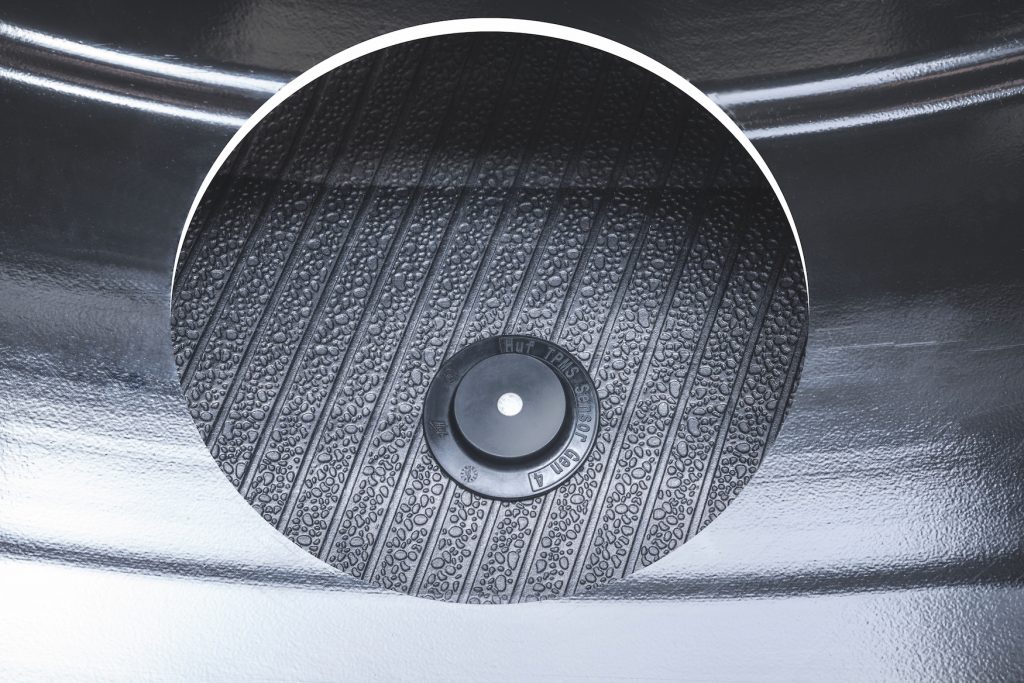

The most advanced systems use sensors that mount on the inside surface (on the innerliner) of the tread. These measure pressure, temperature and many other parameters. Over the years, the hardware has progressed so fast that these innerliner-mounted sensors are now available via the aftermarket.

We are now at the point where the hardware should be standardized. That would enable telematics systems and specialized TPMS to be tire-agnostic. That is to say, if the sensors were standardized and fitted to all tires, any software would not need different protocols to interpret the data coming off a Pirelli tire or a Continental tire, for example. The fact that some tire makers continue to promote their own proprietary solutions reveals a major fault line in the tire industry.

TPMS advancement

The next step is emerging in the commercial vehicle sector. The essential components are a standardized p-T sensor, and a range of analysis software, communications software and user interface software. Optional added extras include predictions about tire life, tread life and tire performance, driven by artificial intelligence (AI).

The big challenge for the industry is that successful implementation relies on a range of software types: communications to get the data off the vehicle and into the cloud; analytic software to exploit the ‘dirty’ data coming out of many vehicles and extract useful information about tire pressure and temperature and other information; database software to collate data from different vehicles and present it in a way that is useful to the fleet operator; and finally, AI predictive modeling that takes the processed data and compares it with historical benchmarks to pick up any changes from established usage patterns and make predictions about how that will affect delivery times, tire life and other factors.

These new services around the development of TPMS are a key element of the future of the tire industry. And if tire makers were to cooperate, then take-up of systems would be faster and more widespread. The insistence on proprietary solutions holds the industry back, and leaves it open to third-party companies, which can build systems that are sensor-agnostic. Standardizing on sensors would enable tire makers to build software that can be tire-agnostic. As it stands, however, third-party platforms may eventually dominate the market, excluding tire makers from the lucrative opportunities to support the fleets in their quests to improve efficiency and profitability.